- Remember your password, and the difference between the Landonline password and a Passphrase. If you enter the Passphrase incorrectly three times, the system locks your digital certificate.

- Scroll to the end of the instrument details before moving on.

- Ensure you read all certifications.

- You can go directly to the instrument screen from Workspace. You don't have to open the Create Dealing screen.

- If you expand the tree in Workspace, you can see the status changes to each dealing and instrument by the change to the icon next to the instrument or dealing.

- If you make a mistake, click the Restore button to clear any prevalidation and signing then start again.

- The Transfer instrument only changes to a status of Signed when both parties have signed.

- Saved work only displays in the My Work folder in Workspace for the Primary Contact who created the dealing. If you are certifying and signing, you need to look in the Supervised Work or All Work folders.

- Landonline will not allow you to certify and sign if you don't have the correct privilege.

- You can pre-validate both dealings and instruments.

- A message is sent to the other party in the dealing once certification is completed for each multi-party instrument. For single-party instruments, no messages are sent to confirm certification.

- You should print at the certify stage for your records.

Property tax information and the signing process

Since 1 October 2015, property tax information has formed part of transfers and other dealings (see Dealings that need property tax information)

Each party to a transfer must complete a Land Transfer Tax Statement, which contains tax information required by the Land Transfer Act 2017. A new format of Land Transfer Tax Statement was introduced in December 2016.

Tax information from the Land Transfer Tax Statement must be entered in Landonline before roles in a transfer of land can be signed. Tax information remains confidential to each firm.

Landonline uses two checks to confirm tax information is complete and that signing can proceed. You can run these at any time by pre-validating the transfer or dealing:

- T046 – Checks that there are no names without tax information entered

- T048 – Checks that entered tax information is complete

When these rules pass they will ensure that:

- all roles in the transfer that the Conveyancing Professionals (CP) firm is linked to have complete tax information.

- all instances of a multiparty role (e.g. multiple firms act for different Transferees) have complete tax information.

As a result the following scenarios apply:

| Scenario | Tax information criteria |

|---|---|

| One firm transfer, one certifying practitioner - Firm A acts for Transferor and Transferee |

All tax information must be completed before the transfer (Transferor and Transferee roles) can be signed. |

|

Two firm transfer, two certifying practitioner - Firm A acts for the Transferor |

Transferor and Transferee roles can be signed independently of each other if tax information is complete for the respective role. |

|

Three firm transfer, three certifying practitioners - Firms A and B act for two Transferors |

Tax information must be completed for both firms A & B before either of Transferor roles can be signed Firm C can sign once they have provided their own tax information as they are independent of firms A and B |

|

Two firm transfer, two certifying practitioners - Firm A acts for the Transferor and one of two Transferees |

Tax information for all three roles must be completed before firm A can sign for either the Transferor and/or Transferee Tax information for the Transferee must be completed for firms A & B before B can sign for the Transferee |

|

Three firm transfer, two certifying practitioners - Firm A acts for the Transferor |

As for the second example above, each CP can sign independently of each other - There are two firms acting in the Transferee role. This has no effect on signing but note that each of those firms is able to access the Tax information for the Transferee |

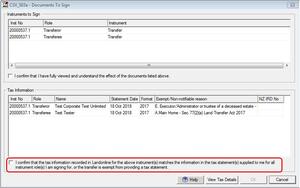

When signing a transfer of land, after completing certifications the Documents To Sign screen will display as follows:

The tax information panel allows the CP to review the tax information associated with each name they are signing for, without the need to access the Prepare screens and review this information.

This panel will display key tax information for all names the CPs firm is associated to, regardless of whether the CP has chosen to sign for all names or just some of them. To see full information as opposed to a summary, and to be able to save tax statements as part of the signing process, use the View tax Details button.

An additional confirmation has been added that must be completed when a CP certifies and signs a transfer instrument. The purpose of this is to confirm the tax information supplied by a client matches the tax information lodged with the dealing as this is the CP’s responsibility.

Note:

Changes to tax information after an instrument has been Signed or Released will clear signing for the instrument, just as other changes to information in the Prepare screens do. However, opening the Prepare Tax Statements screen to view information will not clear signing.