The Tax statements page shows a summary of all the instruments and roles that require tax statements in the dealing.

Depending on where you’re in a dealing, you have a range of ways to navigate to the Tax statements page.

You can only access the Tax statements page when the instrument and estate type require tax details.

Four ways to get to the tax statement page

You can navigate to the Tax statements:

- From your Landing page. Select the 3-dot menu at the end of a dealing row. Then select Tax Statements.

- From within a dealing. Select Tax statements from the dealing navigation bar.

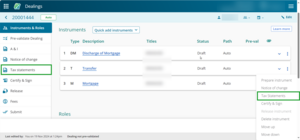

- From the Instrument & Roles page. Select the 3-dot menu next to the transfer instrument. Then select Tax Statements from the drop-down menu.

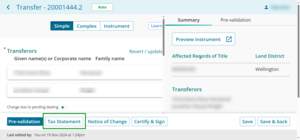

- Select the Tax Statement button on the Prepare instrument page.

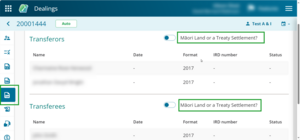

Māori land and treaty settlements

If the transaction relates to Māori land or is part of a Treaty settlement:

- Navigate to the Tax statements page.

- Slide the Māori land or treaty settlement? toggle to the right.

The tax statement will show as complete and you won't need to complete the tax statements.